Linda McQuaig tells the history -- and the real story -- behind the Liberal government's attempt to close a tax loophole:

Twenty-five years ago, Brian Mulroney’s Conservative government introduced a tax change beneficial to wealthy families owning private trusts. One of the arguments used to justify the change was that it would help families with a trust support a disabled child.

The image of helping a disabled child certainly softened the image of what the government was doing — channelling hundreds of millions of dollars in tax savings to some of the wealthiest families in the country.

The amount of money that the wealthy have added to their annual incomes is staggering:

Once this invisible income — amounting to an astonishing $48 billion in 2010 — is added to their reported personal incomes, Canada’s rich are considerably richer than we’ve been led to believe.

For instance, according to commonly used data (for 2011), the average income for those in Canada’s top 1 per cent was $359,000. But once the income they held in private corporations was added, the actual average annual income of these folks was a much heftier $500,200.

The higher up the income ladder, the more popular private corporations have become. Roughly 80 per cent of the richest .01 per cent of Canadians funnel income through private corporations and the amounts involved are substantial, the study found.

The average income for those in the top .01 per cent was $4.69 million a year — an enormous income. But once the income held in their private corporations was added, the average income in this privileged group actually jumped to a stunning $8 million a year.

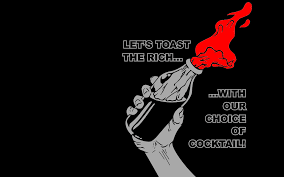

The Conservatives claim that they are fighting for Mom and Pop businesses and small farmers. These folks are now the disabled children of twenty-five years ago. But that line was a red herring then. And the Conservatives' argument is a red herring now.

It's all about distraction.

Image: btlonline